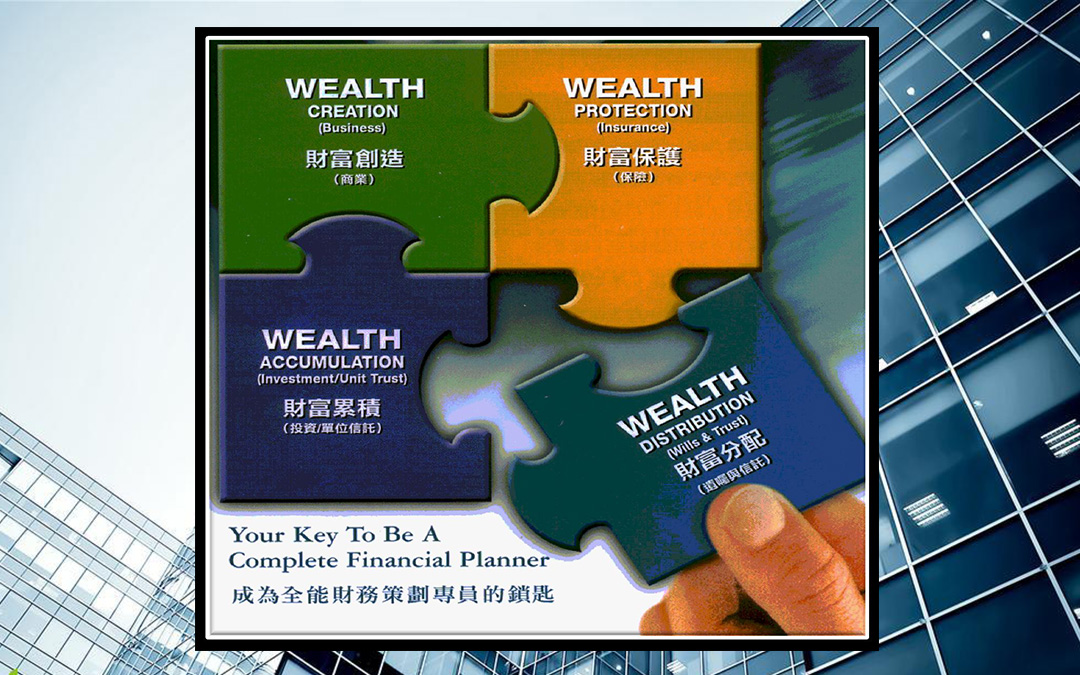

Financial planning is about developing strategies to help you manage your financial affairs and meet your life goals.

1. Wealth Creation

We develop and groom our agents to be a professional financial advisor to have the ability to help others while building a business with outstanding flexibility and income potential.

Agency Development – we provide training and education for field force, with the opportunity to grow and to build own wealth in this industry. In future, you are able to venture into business model like :

- Retail Shop (insurance advisor)

- Branches (USM)

- Franchise (GSM)

- Passive Income (Deferred benefit and other investment)

- Business Opportunity Program

- Agency Financing Scheme (AFS)

2. Wealth Protection

When it comes to managing your wealth, one of the most important aspects to consider is how you protect yourself against the unexpected. Accidents, illness and sudden deaths happen every day — and in a blink, you could lose the assets and the lifestyle you’ve worked so long to achieve.

What we provide:

- Life Insurance

- Medical & Health Insurance

- Mortgage Increasing Insurance

- General Insurance

3. Wealth Accumulation

Regardless of when you begin to accumulate wealth, a successful plan will require:

- A long-term investment strategy

- A commitment to seeing that strategy through An understanding of your tolerance for risk

You need an effective plan for setting money aside for the future one that will allow you to maintain your current lifestyle and is also consistent with your investment goals, risk tolerance and the amount of time you have to save.

What we do:

- Retirement planning

- Children education planning

- Endowment savings

- Investment saving plan

4. Wealth Distribution

Generally speaking, wealth is the value of everything a person or family owns, minus any debts. It is their lifetime possession and meant to be passed down to their next of kin or right person so their wealth are not wasted or lost. To protect their estate in the event of unforeseen circumstances, estate planning is important.

What we provide:

- Will writing

- Trust setting

- Business secession planning

- Business value Protection Plan